The tax rate for most of Lakewood is 75. The ST3 sales and use tax rate of 050 is effective April 1 2017 bringing the total sales and use tax rate for Sound Transit to 140.

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Create a Tax Preparer Account.

. Get Involved - Stay Informed. The Finance Director may permit businesses. Online Preparation of your 2021 City of Lakewood Income Tax Return.

Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. The Lakewood Municipal Income Tax Division Division of Municipal Income Tax 12805 Detroit Ave Suite 1 Lakewood OH 44107 Phone. Published 72017 301130 Collection of sales tax 301140 Sales tax base Schedule of sales tax 301150 Retailer Multiple locations.

To figure out the taxes on a piece of property with a. Lakewood Economic Development makes sure your start-up existing or expanding business benefits from the Citys collaboration and support. Sales tax returns may be filed annually.

The City portion 3 must be remitted. Use our Sales Tax and Licensing System to. Annual returns are due January 20.

Learn more about transactions subject to. Lakewood sales tax online filing Wednesday February 23 2022 Edit. If you filed online or with a tax software and want to pay by check or money order.

There is no change to the due date for filing sales and use tax returns. We cover more than 300 local jurisdictions. Tax rates are provided by Avalara and updated monthly.

Business Licensing Tax. Fourth of July Parade Applications will be Available on May 24th May 15 2022. Accounting budgeting financial reporting cash and debt management investments sales and.

Community Input Needed For City of Lakewood ADA. Payment After Filing Online. Once youve created your PIN and logged into our system you may prepare your.

View your Account history. File and pay a Tax Return using a credit card. Look up 2022 sales tax rates for Lakewood California and surrounding areas.

Or you can contact the City at SalesTaxLongmontColoradogov or 303-651- 8672. Sales Tax 2. Skip to main content.

Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month. Payment Taxes Recent News. The City of Lakewood receives 1 of the.

Re Taxes Small Business Tax Tax Time Business Tax Your Taxes Then And Now Visual Ly Infographic. To utilize the e-filee-pay system. There are a few ways to e-file sales tax returns.

Filing frequency is determined by the amount of sales tax collected monthly. To file a tax return or renewal by using a. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients.

File Sales Tax Online. The Finance Department performs all financial functions for the City of Lakewood. Pay water sewer and stormwater utility bills traffic tickets and business tax returns.

Businesses located in Belmar or the Marston Park and Belleview Shores districts have different sales tax rates. 15 or less per month. Returns and payment are due.

After you create your own User ID and Password for the income tax account you may file a return. If you are filing online the sales and use tax total due and payable must be paid online using an e-check or credit card. Make the check or money order payable to the Colorado Department of Revenue.

Give feedback about projects.

Don T Pay Sales Tax For Home Improvements Ny Nj Pa

5 Of The Cheapest Best Ways To E File Your Taxes In 2022

When Is Tax Day 2022 Tax Deadlines Extensions Child Tax Credit Firstcoastnews Com

Five Things To Know For This Year S Tax Season Wane 15

Ways To File Taxes For Free With H R Block H R Block Newsroom

What Taxpayers Should Know About Protective Claims For Possible Aca Tax Refunds

Tax Tips Ahead Of Monday S Deadline

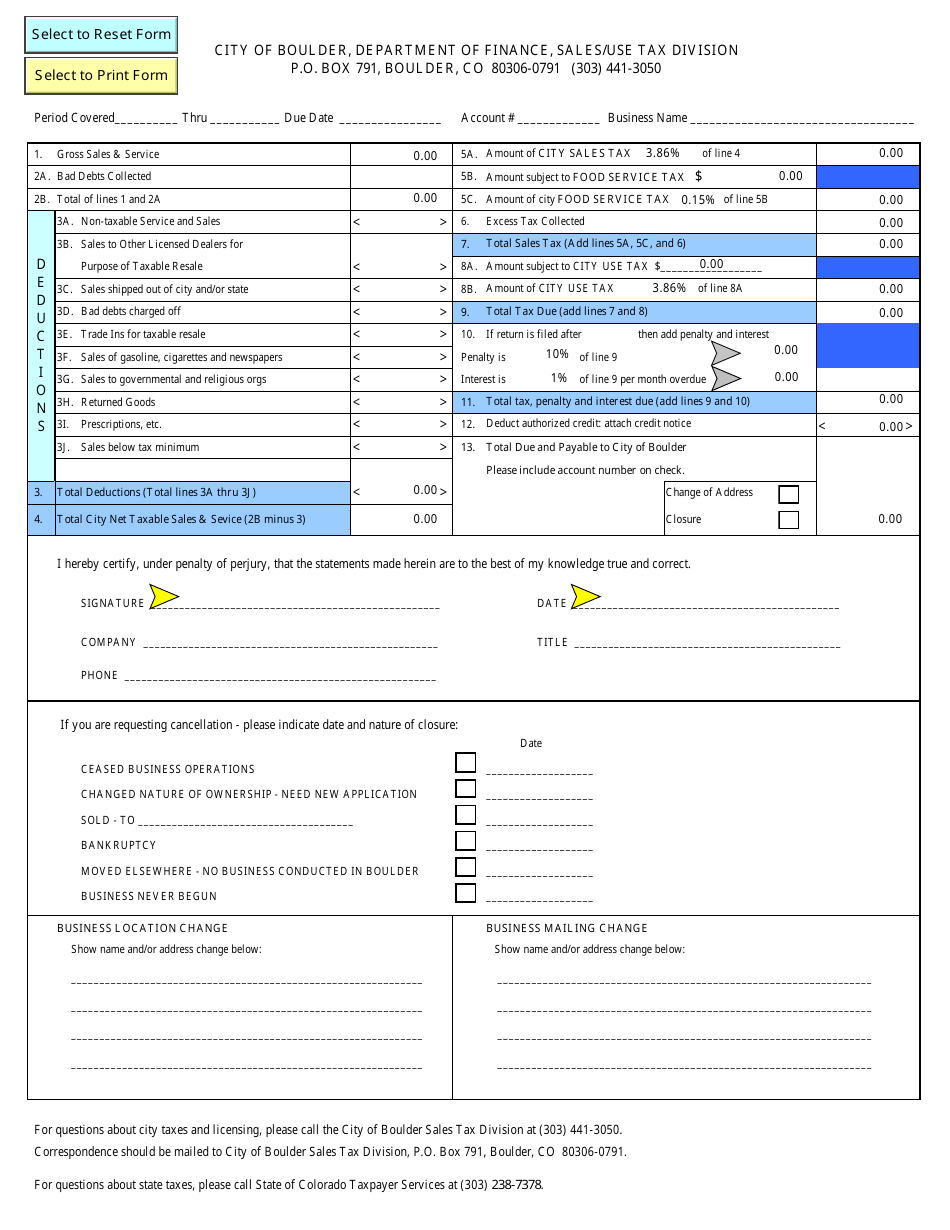

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller

File Sales Tax Online Department Of Revenue Taxation

California State Sales Tax 2018 What You Need To Know Taxjar

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

The Smarter Way To File Your Taxes Infographic Filing Taxes Tax Refund Infographic

Tax Extension 2021 Here Is How To File One

Understanding Your W 2 For All The Visual Learners Out There This Board Is For You We Ve Condensed Complicated Ta Online Taxes File Taxes Online Tax Guide

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

File Sales Tax Online Department Of Revenue Taxation